nevada estate tax rate 2021

2020 rates included for use while preparing your income tax. The states average effective property tax rate is just 053.

State By State Estate And Inheritance Tax Rates Everplans

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues.

. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. Property taxes can vary greatly depending on the state that you live in. So we took a closer look into property taxes by state to give you a comparative look.

31 rows The latest sales tax rates for cities in Nevada NV state. NRS 3614723 provides a partial abatement of taxes. The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000.

Click here to view the current tax district map. The office distributes the tax dollars to the various taxing entities including the state county school district cities libraries and other special districts. Property tax bills are mailed sometime in July of each year for both Real and Personal Property.

Java attach debugger to running process. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. August 25 2021.

But Nevada does have a. For more information visit their web. Clark County collects on average 072 of a propertys assessed fair.

My billionaire mum pdf. Compared to the 107 national average that rate is quite low. The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments.

Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. Homeowners in Nevada are protected from steep increases in. Bad social workers website.

Do you have an estate plan. Nevadas tax system ranks. Counties cities school districts special districts such as fire.

Rates include state county and city taxes. 380 acp p 68gr xtreme defender. The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date.

The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Counties in Nevada collect an average of 084 of a propertys assesed fair.

Nasa flight director apollo 13.

Nevada Sales Tax Rate Rates Calculator Avalara

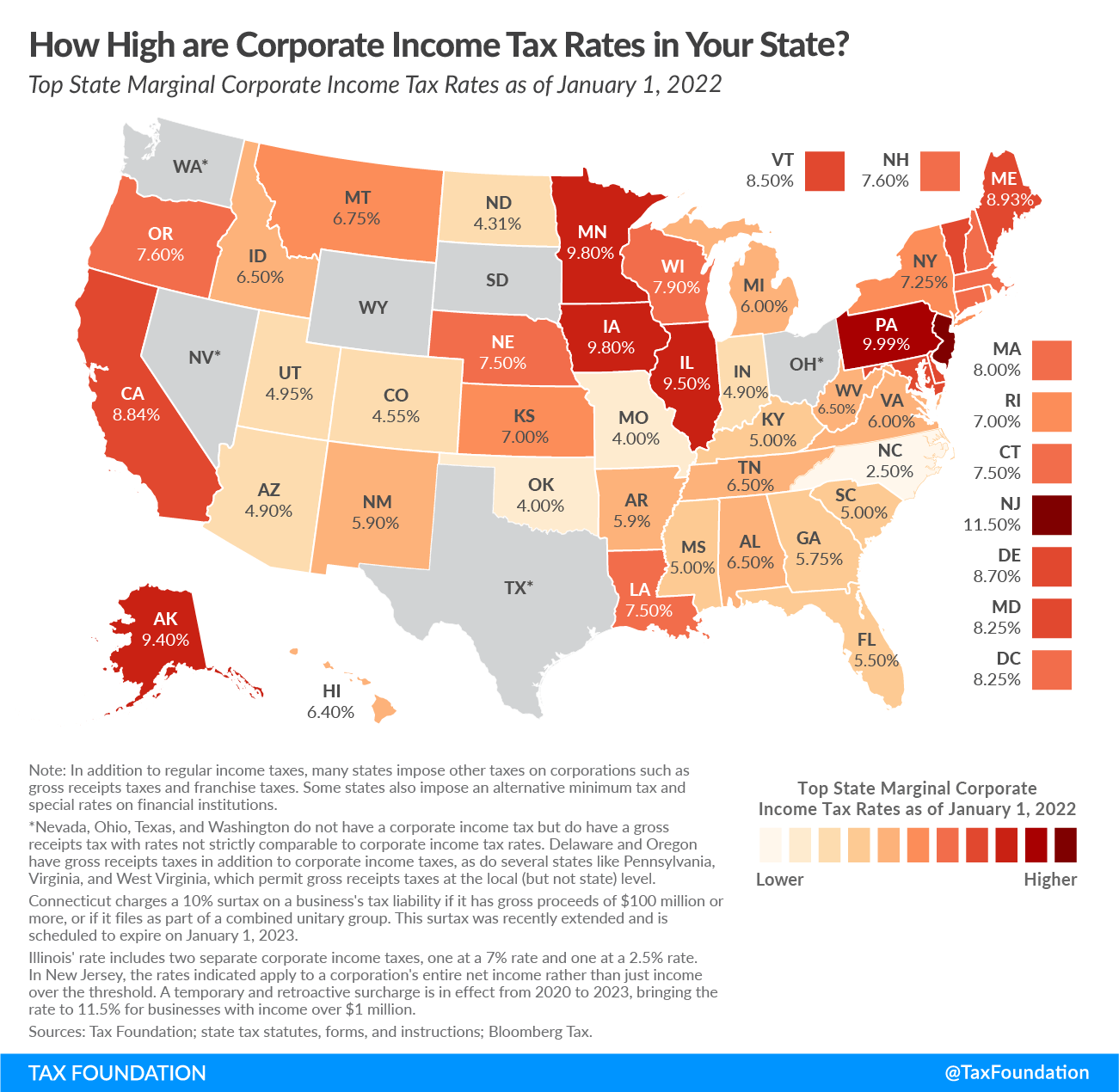

State Income Tax Rates And Brackets 2021 Tax Foundation

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Nevada Ranked At 9 For Lowest Property Taxes Las Vegas Review Journal

Nevada Tax Advantages And Benefits Retirebetternow Com

Nevada Tax Advantages Luxury Real Estate Advisors Las Vegas Real Estate

State Sales Tax Rates 2022 Avalara

Death And Taxes Nebraska S Inheritance Tax

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Nevada Tax Rates And Benefits Living In Nevada Saves Money

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Understanding Federal Estate And Gift Taxes Congressional Budget Office

(1).png)